Deemed Contractor – How a business can be brought into the Construction Industry Scheme

With effect from 6 April 2021, changes to the deemed contractor rules were introduced as part of the Government’s recent review into the Construction Industry Scheme (CIS) which looked to address specific areas where it was considered that certain businesses were gaining tax advantages by not operating the scheme as intended.

What is a Deemed Contractor?

A deemed contractor is a business that is not usually considered as being within construction but can be treated as a contractor if its expenditure on construction operations exceeds the specified limit.

This will often include businesses such as banks, supermarkets, breweries, property investors, utilities companies and telecommunications where their main activity is not that of construction.

What are the changes from April 2021?

The changes introduced from April 2021 now require a business to review the previous 12-month period to check if its cumulative construction costs have exceeded the deemed limit (£3m). Prior to April 2021, a business could be treated as a contractor where it spent an average a £1m or more over a three-year period on construction operations.

When the prescribed threshold (£3m) is now reached, the business will need to register as a contractor and operate the scheme on the next payment it makes to a subcontractor that falls within the scope of CIS.

This means that businesses will no longer be required to review the last 3 accounting periods to check if their construction operations expenditure has exceeded the deemed limit.

More importantly, it now covers a rolling 12-month period, so businesses will need to monitor their construction costs regularly to establish whether they have exceeded the limit.

Consequences of getting it wrong

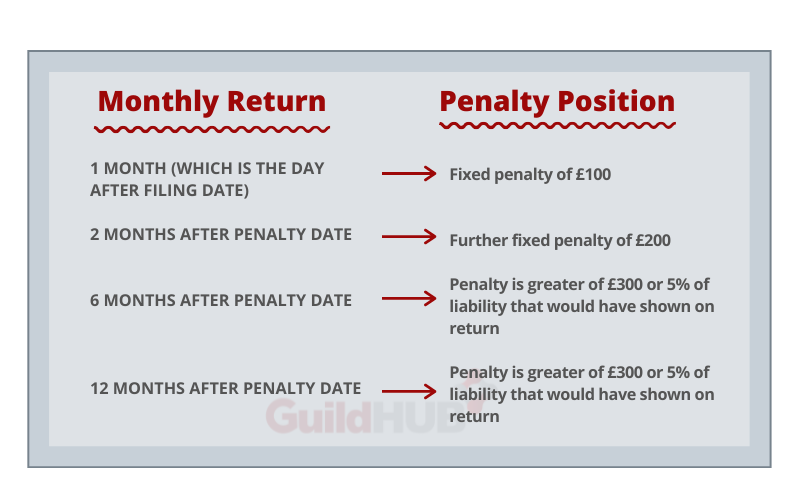

CIS is one area where HMRC will and do regularly charge penalties where contractors have not operated the scheme correctly. Whilst there is no specific penalty for failing to register as a contractor, penalties will be charged where a contractor has failed to submit a monthly CIS return on time.

Each monthly return is liable to the penalty provision and a total of four separate penalties can be charged depending on how late the return is. The penalty position is as follows:

Therefore, it is important that businesses do have suitable processes and procedures in place to identify when the deemed limit has or may be exceeded.

Deemed contractor payments exempted from CIS

Deemed contractors do not have to operate CIS on construction operations expenditure relating to property that is used for the purpose of their own business. This is the Regulation 22 exemption (under SI2005/2045 reg 22).

It is important to note that it is the payment which is exempted – the exemption does not apply to the business itself, nor the construction contract. However, the exemption will not apply where:

- the property is not used for the purpose of the business (e.g. if it is let for commercial purposes to a third party)

- the property is for sale or let (except where purely incidental)

- the property is held as an investment

When establishing the construction operation expenditure, a business will still include amounts covered by the Regulation 22 exemption when checking if the deemed limit has been exceeded for the relevant period.

Deemed contractor ceases to apply

From 6 April 2021, a deemed contractor business can now cease operating the scheme once its expenditure on construction operations falls below the £3m threshold within the previous 12-month period or the contract has ended, and where the business does not expect to make any further payments that fall within the scope of the scheme.

Summary

For a business outside the construction industry, having to consider and establish what is a ‘construction operation’ that falls within the scope of CIS is not necessarily as easy task and this is paramount in deciding whether it meets the definition of a deemed contractor.

Clearly the change in the rules requires that a business must now continually monitor their expenditure on construction operations to allow it to react quickly when the relevant deemed threshold has been reached.

Failure to have suitable processes and procedures in place to correctly identify construction operations expenditure can leave a business open to financial consequences should HMRC establish that deemed contractor status applies but the business fails to register and operate the scheme at the appropriate time.

Here at The Guild, we fully understand the requirement of the scheme and would be happy to discuss this issue further with you. Call 020 8955 2975 or email info@guildhubservice.co.uk and talk to our expert team.

GuildHUB is an information resource, provided free of charge by The Guild, for accounting professionals and their clients. If you wish to contact The Guild, please email contact@trusttheguild.com.

The content of this article is for guidance only and shall not constitute advice. Please seek independent advice or contact GuildHUB for information about its services.

Send us your question and we will be in touch